Contactless Biometrics Explained: Trends, Benefits & Real-World Use

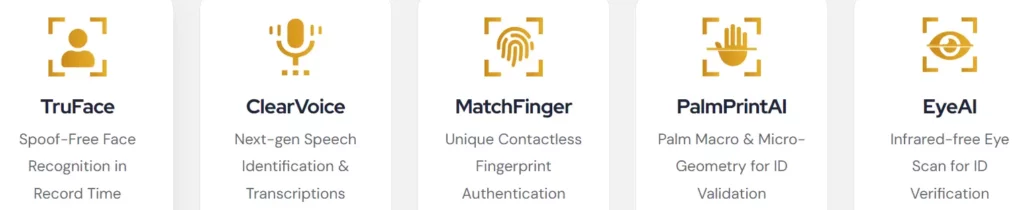

Contactless Biometric Technology: Face, voice, palm, fingerprint, or eye recognition solutions have completely transformed our lives. The usage of biometrics in a contactless form promises the benefits of making payments, marking attendance remotely, securing premise access, preventing unauthorized login, and more without the fear of catching a contagious disease.

According to a source, the contactless biometric technology market size will scale up to $22608 million by the end of this year. It is projected to have a CAGR of 17.8% between 2023 and 2033. It is being applied in healthcare, law enforcement, hotel & hospitality, visa & immigration, and many other industries.

Must Read:

- Future of Face Recognition Technology

- Passwordless Authentication

- Digital Identity Management: Key Challenges and Solutions!

Table of Contents

Real-Life Application of Contactless Biometric Technology

Hospitals and Healthcare Centers

The application of touchless biometrics first came into limelight during the COVID-19 scare. The fear of catching contagious and dangerous infections made people opt for a solution that not only enhanced convenience and hygiene but also security.

Over the years, the healthcare industry has witnessed tremendous change due to the implementation of this technology. According to a source, it has become a useful solution for patient identification, protecting patient data, and providing seamless access control.

In South Korea, it even ensures healthcare service delivery efficiently. The technology can reduce data management hassles, decrease inventory thefts, enable marking staff attendance, and more.

Must Read | Identity Verification Trends of 2024

Law Enforcement

AI-driven biometric authentication solutions have minimized instances of identity theft and fraud through anti-spoofing and anti-tampering mechanisms. Law and order have greatly benefitted through this tech as the unique biometrics identify persons of interest, alert security in real-time, and decrease public harm.

Moreover, the de-duplication of biometric identities has become a major savior in border crossings. The advancements have allowed sending tampering or spoofing attempt alerts in real-time to the security administrators, revamping border security.

Law enforcement officers also issue e-challans or submit criminal activity reports about the correct person. On the other hand, individuals have become less fearful about the instances of identity theft due to the unique features of biometrics.

Also Read: Biometric Boarding: How is it Transforming Airport Experiences?

Banking, Financial Service, and Insurance (BFSI)

The incorporation of touchless biometrics like face and voice recognition has become dominant in the BFSI industry. The leading application includes:

- Securing KYC Processes

- Enabling Digital payments

- Enabling Digital payments

The biometric systems integrate into the BFSI application for providing multi-level secure account access and availing products or services offered by the organization. The risk of penetration into a banking system through unsolicited means has become challenging for hackers as they have to forge biometrics, which includes patterns of an individual’s thumb, fingerprint, or face.

Also Read: Biometrics in Banking: The Need of the Hour

At first, deepfakes became a means of penetrating systems; however, the inclusion of liveness detection with geolocation and timestamp has significantly altered the scene. Now, the system can easily detect any malicious activity, and the organization can take precautionary measures to prevent fraud.

As mentioned earlier, touchless biometrics have entered multiple industries, and their usage has become versatile. The growth expectations seem real due to the heightened level of security and convenience it can provide the end users & incorporations.

Also Read: Remote Biometric Digital KYC: The Growing Practices

Revolutionize identity verification with our Contactless BioKYC platform, offering secure, convenient, and efficient customer onboarding.

The Future of Biometrics as Digital Identities

Biometrics serve as digital identities in the present. You can use face recognition technology to unlock your digital accounts or even mark attendance. Both would have a digital identity in your name. The seamless accessibility of biometrics through an app or web platform streamlines the productivity of the remote workforce.

Such biometric technology that can easily integrate with a device, app, or platform is depleting the need for punching cards or specialized biometric hardware, saving the capital expenditure of organizations while upgrading security. Innovations have reached a stage wherein multiple biometrics can integrate into the accounts, offering heightened multifactor authentication, eliminating the need for carrying a YubiKey, remembering passwords, or entering an OTP/PIN.

Even visitors can schedule their meetings online, receive a mobile QR linked to their Face ID, and visit the enterprise to experience seamless & secure access without interference from the receptionist or waiting in queues. We can only hope for an even better future through the use of contactless biometrics driven by AI, ML, Big Data Analytics, and other technologies.

Also Read: